How an Offshore Trust Can Enable You to Ensure Financial Privacy

How an Offshore Trust Can Enable You to Ensure Financial Privacy

Blog Article

Discover Just How an Offshore Trust Can Improve Your Estate Preparation Strategy

If you're looking to reinforce your estate preparation strategy, an overseas Trust could be the service you need. These depends on use one-of-a-kind advantages that can secure your assets while providing tax and privacy advantages. Nonetheless, lots of people have mistaken beliefs regarding exactly how they function and their importance. Recognizing these components can be crucial for your monetary future. Allow's discover what an overseas Trust can do for you.

Understanding Offshore Counts On: What They Are and How They Function

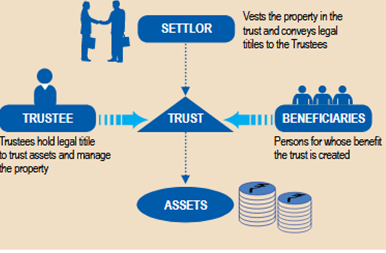

Offshore depends on are powerful financial tools that can assist you manage your properties while supplying benefits like personal privacy and tax advantages. Primarily, an overseas Trust is a legal arrangement where you move your possessions to a count on developed in an international territory. This configuration allows you to different ownership from control, suggesting you do not straight have the possessions anymore; the Trust does.

You'll appoint a trustee to handle the Trust, ensuring your properties are dealt with according to your dreams. By understanding exactly how offshore trusts function, you can make enlightened decisions that line up with your economic goals and supply tranquility of mind for your family's future.

Secret Advantages of Offshore Trusts for Property Defense

While you may not always be able to forecast monetary difficulties, developing an overseas Trust can be a proactive step towards shielding your assets. One essential benefit is the included layer of security it offers against lenders and lawful judgments. By positioning your assets in an offshore Trust, you produce a barrier that makes it harder for prospective complaintants to reach your wealth.

Additionally, offshore counts on can help you secure your properties from financial or political instability in your house country. This geographical splitting up guarantees that your wealth remains protected, even if your residential situation modifications suddenly.

Numerous offshore jurisdictions permit for higher privacy, making it difficult for others to uncover your monetary holdings. In general, an offshore Trust can be a powerful device in your property security strategy, offering you peace of mind.

Tax Obligation Benefits of Establishing an Offshore Trust

When you establish an overseas Trust, you not just improve your asset defense however also disclose important tax obligation deferral chances. This can considerably lower your taxed income and assist your wealth expand in time. Recognizing these advantages can be a game-changer in your estate preparation technique.

Property Security Conveniences

Establishing an overseas Trust can considerably enhance your property protection technique, particularly if you're looking to secure your wealth from lenders and lawful judgments. By placing your properties in a count on, you properly separate them from your personal estate, making it harder for financial institutions to access them. This added layer of security can hinder suits and supply tranquility of mind.

Furthermore, several offshore jurisdictions have robust personal privacy regulations, ensuring your monetary events continue to be confidential. In case of lawful disagreements, having assets kept in an overseas Trust can complicate attempts to take those properties, as it's even more challenging for creditors to navigate international regulations. Inevitably, an offshore Trust is a powerful tool in securing your wide range for future generations.

Tax Obligation Deferment Opportunities

Offshore trusts not only provide robust possession security however additionally existing substantial tax obligation deferral possibilities. By putting your possessions in an offshore Trust, you can potentially delay taxes on earnings and funding gains up until you withdraw those funds. This technique enables your investments to grow without immediate tax liabilities, maximizing your wealth over time.

Furthermore, depending on the jurisdiction, you could gain from lower tax prices and even no tax obligations on specific types of income. This can give you with an extra positive environment for your investments. Making use of an offshore Trust can improve your general estate preparation method, enabling you to control your tax obligation exposure while securing your possessions for future generations.

Enhancing Privacy and Discretion With Offshore Depends On

While numerous people seek ways to secure their assets, making use of offshore trust funds can considerably boost your privacy and confidentiality. By placing your possessions in an overseas Trust, you create a layer of defense versus prospective creditors, claims, and public analysis. This structure typically ensures that your personal info continues to be personal, as overseas jurisdictions commonly offer rigorous confidentiality legislations.

Moreover, the possessions kept in the Trust are not publicly revealed, permitting you to manage your wide range discreetly. You can likewise regulate how and when beneficiaries access their inheritances, better shielding your objectives from spying eyes.

Additionally, the complex legal structures of overseas trusts can prevent those trying to test or access your possessions (offshore trust). Inevitably, picking an offshore Trust encourages you to preserve your financial privacy, supplying tranquility of mind as you navigate your estate planning journey

Planning for Future Generations: Riches Transfer Approaches

As you consider the personal privacy advantages of offshore counts on, it's similarly crucial to think of how to efficiently pass on your riches to future generations. Offshore depends on can function as effective tools for riches transfer, enabling you to dictate how and when your assets are dispersed. By establishing an overseas Trust, you can set certain terms to ensure that your beneficiaries get their inheritance under conditions that line up with your values.

Additionally, offshore trusts frequently supply tax advantages, which can help preserve your wide range for future generations. You can structure the depend secure your possessions from lenders or lawful insurance claims, ensuring that your loved ones profit from your effort. It's likewise wise to involve your family members in conversations regarding your estate plan, cultivating understanding and lowering prospective conflicts. offshore trust. By strategically intending now, you can create a lasting heritage that supports your family for several years to find.

Usual Mistaken Beliefs About Offshore Depends On

What do you truly know regarding overseas depends on? Lots of people think they're only for the ultra-wealthy or those attempting to hide properties. In reality, overseas trust funds can be legit tools for estate planning and property protection for a broader audience. One more typical mistaken belief is that they're unethical or always prohibited. While it holds true that some abuse them for tax obligation evasion, a correctly developed overseas Trust abides by lawful criteria and can provide considerable advantages. You might likewise believe that establishing one up is overly complicated or expensive. While there are factors to consider, many find that the advantages exceed the first investment. Finally, some concern shedding control over their properties. With the best framework and trustees, you can keep a degree of oversight and adaptability. By comprehending these mistaken beliefs, you can make enlightened decisions about whether an overseas Trust fits your estate planning strategy.

Actions to Establishing an Offshore Trust as Part of Your Estate Strategy

Choosing a Jurisdiction

Picking the best territory for your overseas Trust is crucial, as it can considerably affect the effectiveness of your estate strategy. Beginning by looking into countries with beneficial Trust legislations, tax obligation advantages, and strong asset security. In addition, think about the expenses connected with establishing up and maintaining the Trust in that jurisdiction, as charges can vary substantially.

Picking a Trustee

Just how do you assure your offshore Trust runs efficiently and successfully? Think about experts like attorneys or read this article financial advisors that specialize in overseas depends on.

You must likewise evaluate their communication design-- guarantee they're responsive and transparent. Evaluate their fees upfront to avoid shocks later. It's sensible to examine their track record with various other clients. A solid track record can provide you self-confidence that your Trust will certainly be handled efficiently, straightening with your estate preparing goals. Pick intelligently, and your overseas Trust can grow.

Funding the Trust

Once you have actually picked the right trustee for your offshore Trust, the following action is funding it efficiently. You'll desire to move properties into the Trust to ensure it accomplishes your estate intending goals.

Remember the tax ramifications and the laws of the offshore jurisdiction. Make sure to document each transfer appropriately to keep openness and adhere to legal requirements. Once moneyed, your overseas Trust can give the advantages you look for, such as asset protection and tax effectiveness, improving your general estate planning method.

Often Asked Concerns

What Is the Distinction In Between an Offshore Trust and a Domestic Trust?

An offshore Trust's assets are held outside your home country, offering privacy and potential tax obligation advantages. In comparison, a residential Trust operates within your country's laws, frequently lacking the same level of property defense and discretion.

Can I Handle My Offshore Trust Assets Directly?

You can not handle your overseas Trust assets straight as a result of lawful limitations. Instead, a trustee oversees those properties, making certain conformity with guidelines and safeguarding your interests while you profit from the Trust's advantages.

Are Offshore Trusts Legal in My Nation?

Yes, offshore trusts are legal in many countries, but regulations differ. You'll require to research your nation's regulations or seek advice from a legal expert to assure conformity This Site and understand any tax obligation ramifications involved.

Just how Much Does It Price to Establish an Offshore Trust?

Establishing up an offshore Trust commonly sets you back between $5,000 and $20,000, depending on the intricacy and jurisdiction. You'll intend to talk to a legal specialist to obtain an visit their website accurate price quote for your certain needs.

What Happens to My Offshore Trust if I Move Countries?

If you move nations, your offshore Trust's tax effects and legal standing might alter. You'll need to get in touch with professionals in both territories to ensure conformity and make required changes to preserve its advantages and securities.

Verdict

Incorporating an overseas Trust into your estate preparation can be a game-changer. It not only guards your properties from prospective hazards but additionally offers tax advantages and enhances your privacy. By preparing for future generations, you'll guarantee your riches is maintained and passed on according to your desires. Do not let false impressions hold you back; with the best support, you can establish an offshore Trust that absolutely protects your tradition. Beginning exploring your options today!

Basically, an overseas Trust is a legal plan where you move your properties to a trust fund developed in a foreign jurisdiction. In the event of legal disputes, having possessions held in an offshore Trust can complicate attempts to take those possessions, as it's more difficult for lenders to navigate foreign legislations. Using an offshore Trust can enhance your overall estate planning strategy, allowing you to control your tax obligation direct exposure while safeguarding your properties for future generations.

As soon as moneyed, your overseas Trust can supply the benefits you seek, such as property security and tax obligation efficiency, improving your overall estate planning approach.

What Is the Difference Between an Offshore Trust and a Domestic Trust?

Report this page